Company Tax Rate 2024 – Whether you’re a business owner or an employee Employers must pay FUTA taxes on employees who make $1,500 or more throughout the year. The FUTA tax rate is 6% on the first $7,000 in income. After . Americans who fail to make on-time and accurate estimated quarterly tax payments could be hit with a surprise bill after the IRS penalty jumped to 8%. .

Company Tax Rate 2024

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

Source : itrfoundation.org2024 State Corporate Income Tax Rates & Brackets

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

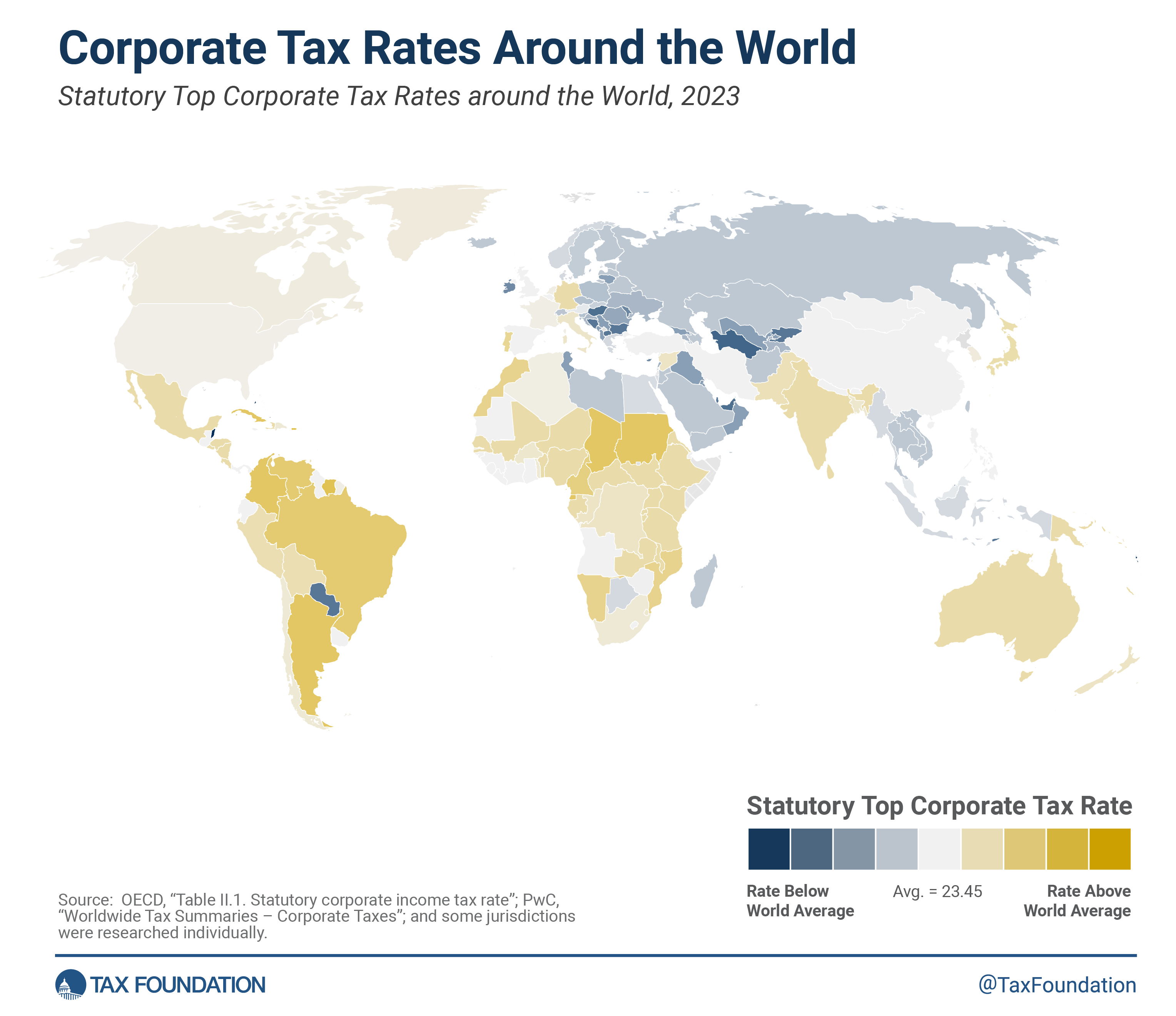

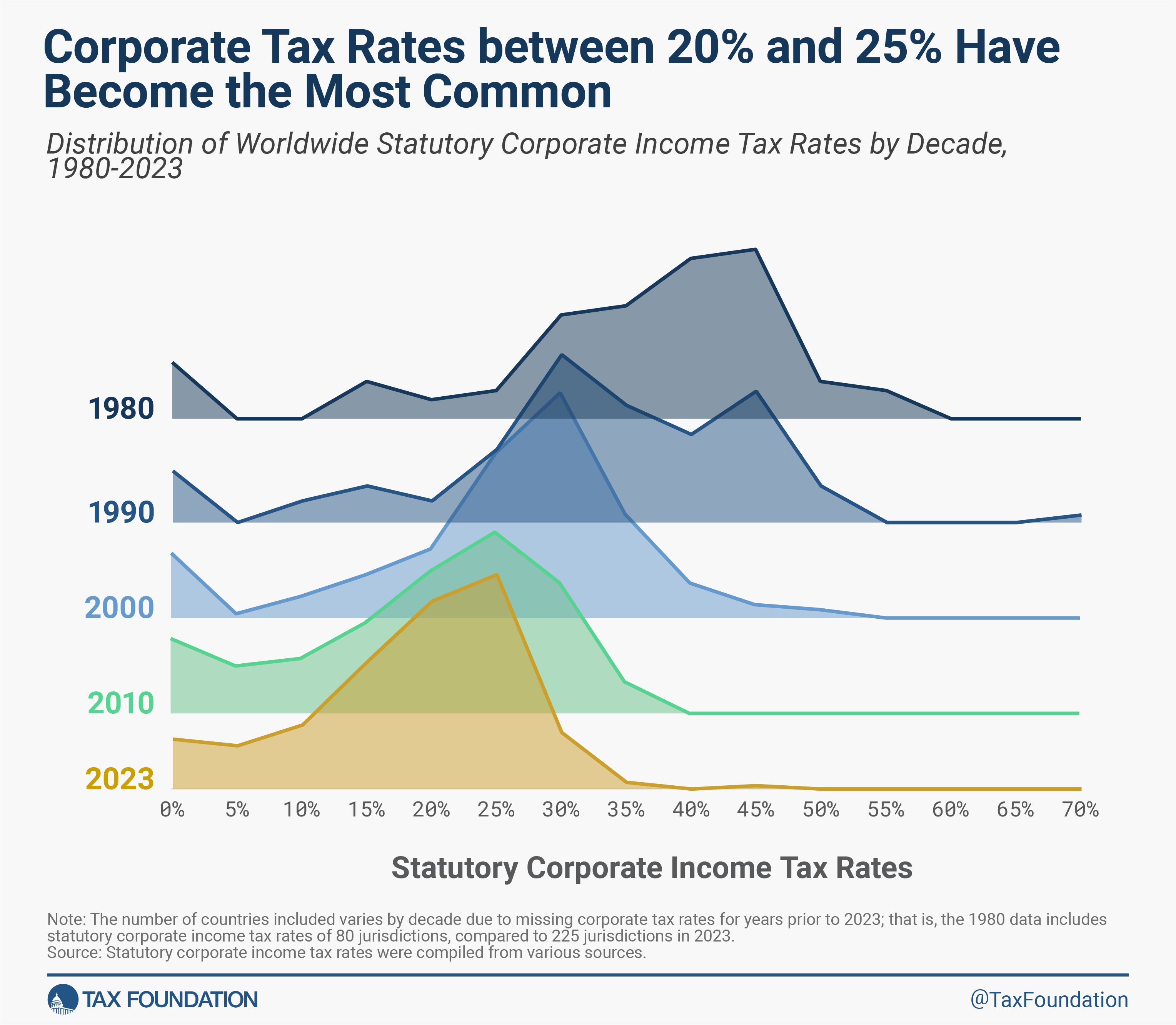

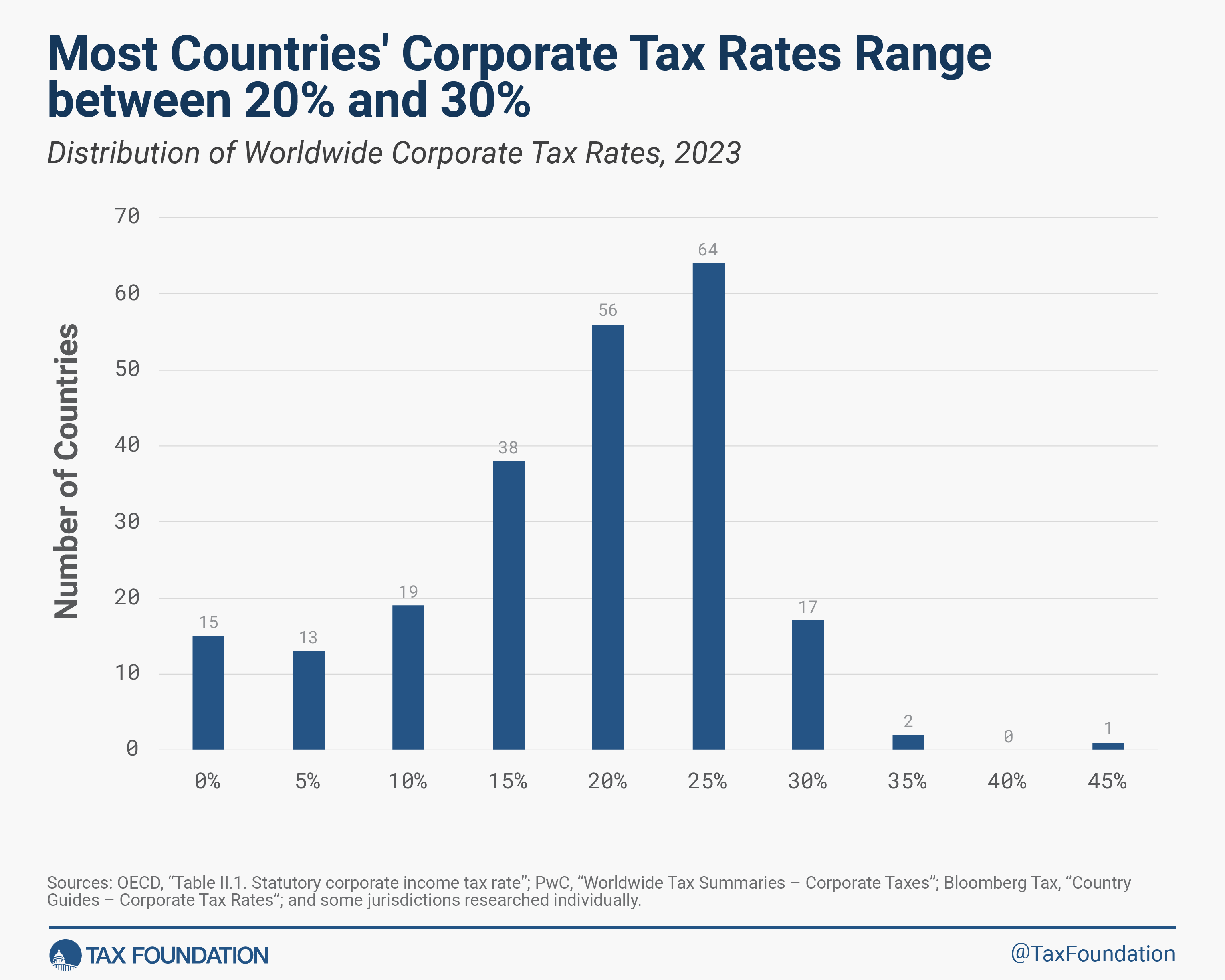

Source : itrfoundation.orgCorporate Tax Rates around the World, 2023

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

Source : itrfoundation.orgCorporate Income Tax Definition | TaxEDU Glossary

Source : taxfoundation.org2024 will herald the end of a race to the bottom in corporate tax

Source : www.ft.comCorporate Tax Rates around the World, 2023

Source : taxfoundation.orgLimited company directors current corporation tax rates. Changes

Source : www.tiktok.comCompany Tax Rate 2024 2024 Corporate Income Tax Rates in Europe | Tax Foundation: President Biden has supported bumping the corporate tax rate up to 28 percent from Trump’s level of 21 percent. He wants to raise taxes on the wealthy in order to reduce the deficit by between $3 . City of Sacramento voters in the March 2024 election will decide whether to pass a controversial update to the business operations tax. .

]]>